CoinLander Expands RWA Innovation Beyond Property Crowdfunding With Mortgage Debt Tokenization

ROAD TOWN, British Virgin Islands, Nov. 25, 2025 (GLOBE NEWSWIRE) -- CoinLander is pioneering a new model in the Real World Asset (RWA) space by becoming the first platform to tokenize real estate mortgages, distinguishing its debt-based approach from the equity-focused property crowdfunding platforms prevalent in the market. This innovative model has found immediate market validation, with the platform surpassing $690,000 in Total Value Locked (TVL) across 15 projects with a 100% fulfillment rate.

The platform’s early performance validates a strong investor appetite for an alternative to property equity speculation. Investors are earning APRs of up to 12% derived from consistent, monthly interest payments from borrowers. This provides a predictable income stream, a key differentiator from the long-term, appreciation-dependent returns typical of property crowdfunding models.

Introducing a Unique RWA Model

The core difference between CoinLander's model and other RWA platforms lies in the asset being tokenized: debt versus equity. Most RWA real estate platforms focus on property crowdfunding, where investors buy fractional ownership of the physical property itself. In that model, they are "fractional landlords" whose returns are tied to variable rental income and the property's future appreciation.

CoinLander takes a different approach by tokenizing the mortgage debt, not the equity. Investors here are not buying a piece of the building; they are funding the loan secured by it. This positions them as "the bank," earning a predictable yield from consistent, contractually obligated interest payments, without direct exposure to the property's price volatility.

A Multi-Trillion Dollar Niche

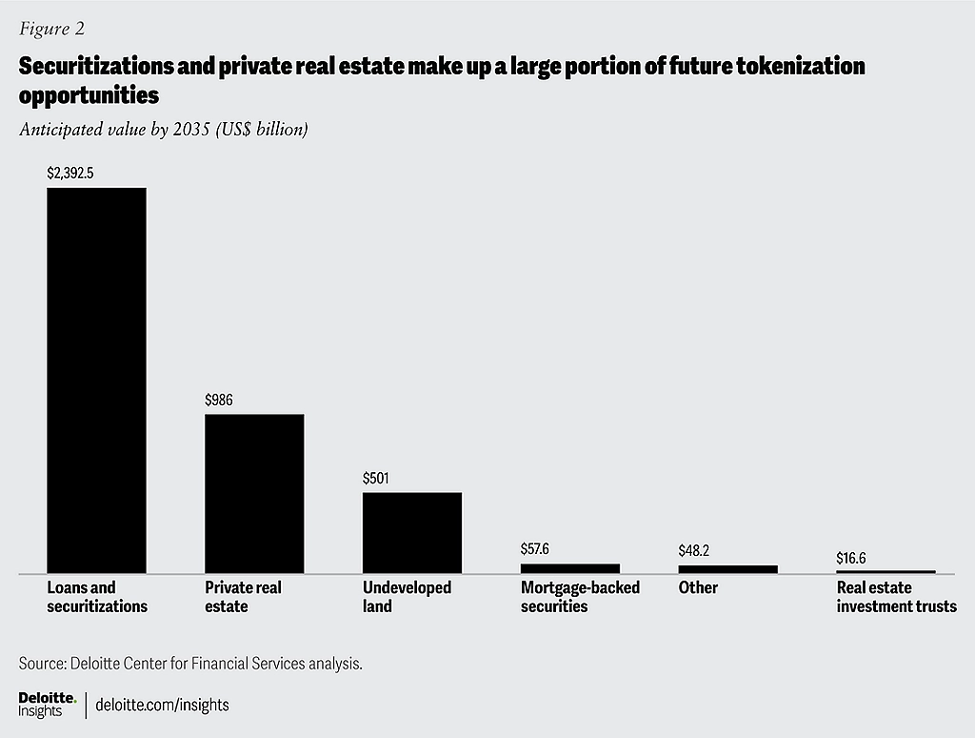

Source: Deloitte

CoinLander operates within a massive, high-growth niche. A Boston Consulting Group report projects the overall asset tokenization market could reach $16.1 trillion by 2030. More specifically, Deloitte forecasts that the market for tokenized loans and securitizations is set to hit $2.39 trillion by 2035. This data shows CoinLander is an early mover in a substantial sub-sector. The sheer scale of the underlying asset is immense, with FRED data showing total US mortgage debt outstanding at approximately $21 trillion.

A Superior RWA Primitive

The mortgage debt model offers distinct advantages over property equity tokenization. Debt instruments are generally more standardized than unique, fractional shares of a physical property, which can lead to superior liquidity. Returns are based on fixed monthly loan payments, making them less directly correlated to the volatile swings of the real estate market. The due diligence process mirrors traditional finance, focusing on borrower creditworthiness and conservative loan-to-value ratios to mitigate risk. This structure delivers a predictable passive income stream from contractually mandated debt servicing, unlike variable rental profits or uncertain future sales.

"The market is seeing a wave of RWA platforms focused on property crowdfunding, and it's creating a lot of noise," said RΞN, Founder and CEO of CoinLander. "We need to be crystal clear: CoinLander is not one of them. We are pioneering mortgage debt tokenization. Our investors aren't speculating on property values; they are earning stable, predictable yields from the debt secured by those properties. We are offering access to an institutional-grade credit market, and our early growth to nearly $700K in TVL proves that sophisticated investors understand and demand this distinction."

To learn more or review the latest investment opportunities, head over to the CoinLander website and connect with the team on X/Twitter, Telegram, or LinkedIn.

About CoinLander

CoinLander is a pioneering Real World Asset (RWA) platform that bridges the gap between traditional finance and the digital asset economy. It tokenizes high-quality, real-life mortgage investments, allowing users to earn predictable monthly interest backed by tangible property assets. The platform, which officially rolled out on October 20, 2025, transforms illiquid real-estate debt into accessible digital investments, offering a stable alternative to the volatility of traditional crypto markets. In less than four weeks after its launch, CoinLander's Total Value Locked (TVL) surged past the $600K mark, signaling strong investor demand for stable, property-backed yield in the crypto market.

Media Contact:

Team CoinLander

partner@coinlander.com

Disclaimer: This content is provided by sponsor. The statements, views, and opinions expressed in this content are solely those of the content provider and do not necessarily reflect the views of this media platform or its publisher. We do not endorse, verify, or guarantee the accuracy, completeness, or reliability of any information presented. We do not guarantee any claims, statements, or promises made in this article. This content is for informational purposes only and should not be considered financial, investment, or trading advice.Investing in crypto and mining-related opportunities involves significant risks, including the potential loss of capital. It is possible to lose all your capital. These products may not be suitable for everyone, and you should ensure that you understand the risks involved. Seek independent advice if necessary. Speculate only with funds that you can afford to lose. Readers are strongly encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. However, due to the inherently speculative nature of the blockchain sector—including cryptocurrency, NFTs, and mining—complete accuracy cannot always be guaranteed. Neither the media platform nor the publisher shall be held responsible for any fraudulent activities, misrepresentations, or financial losses arising from the content of this press release. In the event of any legal claims or charges against this article, we accept no liability or responsibility. Globenewswire does not endorse any content on this page.

Legal Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/fe191d44-3a1c-4a87-b177-cdf1d1b6e6f1

https://www.globenewswire.com/NewsRoom/AttachmentNg/4f6e2f6b-a391-4455-bdf1-2b027b33ed88

https://www.globenewswire.com/NewsRoom/AttachmentNg/62ba0dcc-e178-452d-9651-c7a92f74754d

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.